How Much Money Was Spent In Dec 2017

The Vitals

Before and later passage of the Tax Cuts and Jobs Deed (TCJA), several prominent conservatives, including Republicans in the House and Senate, former Reagan economist Art Laffer, and members of the Trump administration, claimed that the act would either increment revenues or at to the lowest degree pay for itself. In principle, a taxation cut could "pay for itself" if it spurred substantial economic growth—if tax revenues rose from the combination of higher wages and hours worked, greater investment returns, and larger corporate profits. The TCJA, nevertheless, is not that tax cut.

-

The actual amount of revenue enhancement revenue nerveless in FY2018 was significantly lower than the CBO's projection fabricated in January 2017—before the revenue enhancement cutting was signed into police force.

-

Given that the economy grew in 2018, and in the absence of another policy that could have acquired a large revenue loss, the data imply that the 2017 revenue enhancement cut substantially reduced revenues.

-

The 2017 tax cut reduced the top corporate taxation rate from 35 pct to 21 percent—a 40 percent reduction. It also reduced income taxes for most Americans.

A Closer Wait

Did the TCJA spur enough growth to maintain federal acquirement levels?

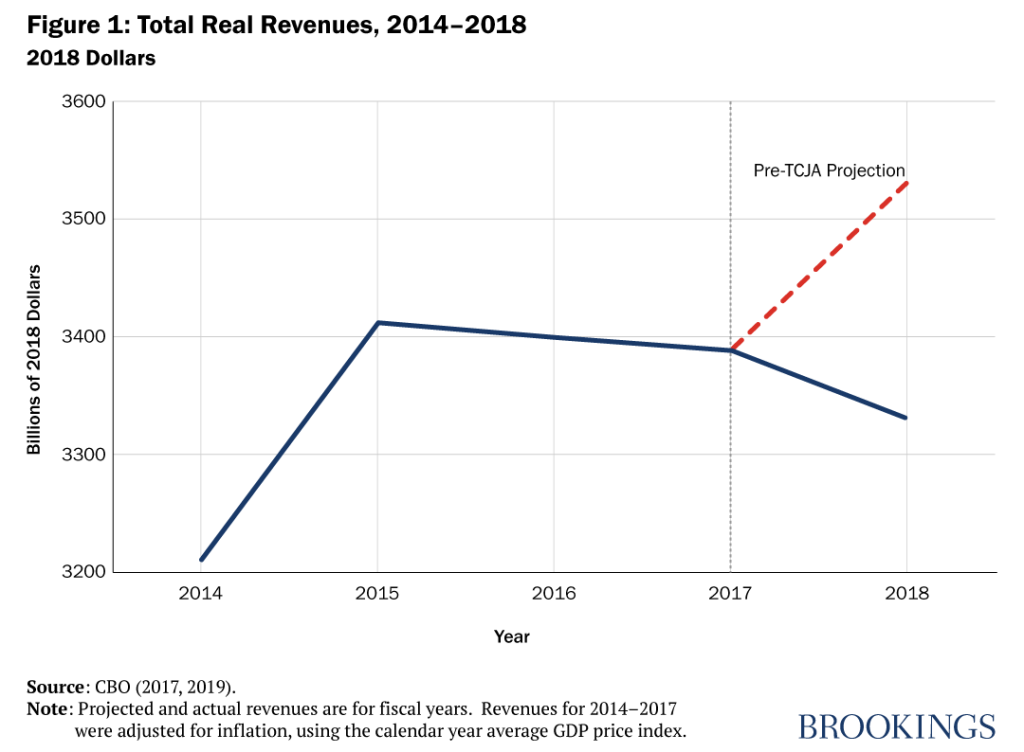

While some TCJA supporters observe that nominal revenues were college in fiscal yr 2018 (which began October. ane, 2017) than in FY2017, that comparison does not accost the question of the TCJA's furnishings. Nominal revenues rise because of inflation and economic growth. Adjusted for inflation, total revenues fell from FY2017 to FY2018 (Figure one). Adapted for the size of the economy, they fell even more.

The right question: What would revenues have been without the TCJA?

The about appropriate test of the acquirement bear upon of the TCJA is to compare actual revenues in FY2018 with predicted revenues in FY2018 assuming Congress had not passed the legislation. In fact, the actual amount of revenue collected in FY2018 was significantly lower than the Congressional Budget Office's (CBO) project of FY2018 revenue made in January 2017—earlier the tax cuts were signed into police in Dec 2017. The shortfall was $275 billion, or 7.6% of revenues that were expected before the tax cuts took place. Given that the economy grew, and in the absence of another policy that could take acquired a big acquirement loss, the data imply that the TCJA substantially reduced revenues (Figure 1).

What does the limerick of the revenue shortfalls tell united states virtually the upshot of the TCJA?

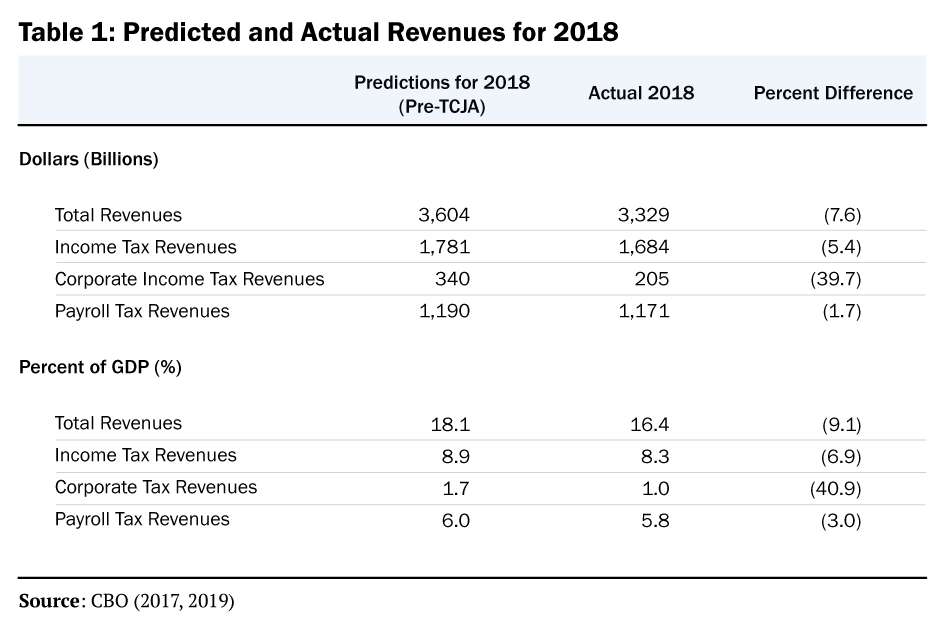

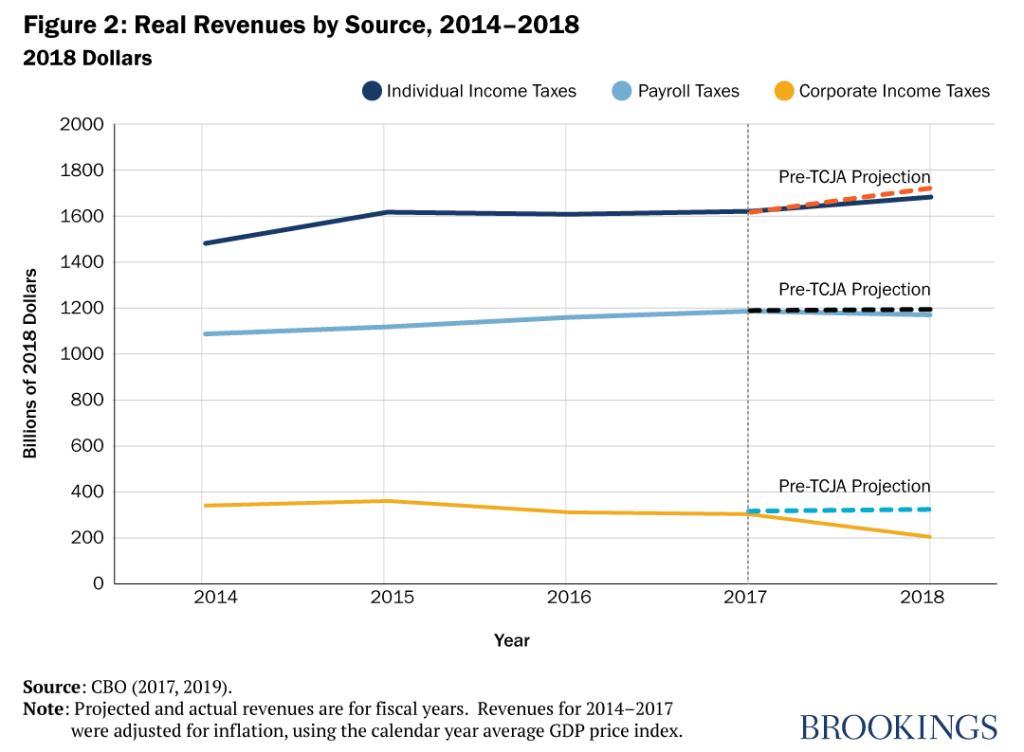

The TCJA'due south changes mostly affected the corporate and individual income taxes (Figure two). The act reduced the top corporate tax rate from 35% to 21%—a 40% reduction. Actual corporate income tax revenue in FY2018 was $135 billion lower than CBO's projection from 2017—well-nigh exactly a 40% decline. The most contempo CBO projections approximate further decreases in corporate taxation acquirement. The TCJA also reduced income taxes for nigh Americans, which led to a decline in revenues relative to prior projections. For individual income taxes, actual collections in FY2018 were $97 billion, or 5.4%, below pre-TCJA projections.

These effects are accentuated if ane looks at taxes as a share of Gross domestic product (Table 1). In 2017, before the tax cuts were considered, the CBO estimated that total revenues would be 18.1% of GDP in FY2018. With the TCJA, revenues were merely sixteen.four% of Gdp. Similar patterns agree for individual income taxes and (in more than extreme form) for corporate income taxes. Due to data limitations, the revenue numbers in Table one are on a financial year (October 2017–September 2018) basis. As a upshot, 2018 data include the three months prior to the act'south enactment. If the values were instead on a calendar year basis so that 2018 simply included post-TCJA revenues, the revenue declines would be even larger.

Are the differences between projected and actual revenues actually caused by the TCJA?

These shortfalls can't exist attributed to errors in the CBO's pre-TCJA forecast. To illustrate this, it makes sense to look at projected and actual payroll tax revenues, considering the TCJA did not straight bear on payroll taxes. In fact, payroll taxes fell simply slightly—1.7%—from pre-TCJA projected values (Figure 2). This provides baseline credibility that reinforces the declines in other revenues.

Were the TCJA's acquirement furnishings anticipated?

None of these findings should be surprising. Near every major analysis of the legislation correctly predicted that revenues would autumn in 2018 relative to a scenario without the tax cuts, with sources ranging from government entities such as the CBO and the Joint Commission on Taxation, to non-governmental think tanks such as the Urban-Brookings Tax Policy Eye and the Tax Foundation, academic researchers in studies past Robert Barro and Jason Furman, and in analyses using the Penn-Wharton Budget Model.

Could the revenue shortfalls be a temporary outcome of sudden policy change?

For those who might fence to "wait and see" what has happened in 2019, the findings from the studies cited to a higher place offer little hope. On average, these models estimated that economic growth furnishings (the "dynamic effects") will just start about a quarter of the 10-year revenue loss associated with the TCJA. Excluding the Revenue enhancement Foundation, which is an outlier in these estimates, drops the average offset to less than 20%.

Then did the TCJA pay for itself?

The TCJA did non pay for itself, nor is it likely to practice so in the hereafter. In that location are many debates to have about the TCJA, but whether it raised or reduced revenues in 2018 should not be i of them.

I give thanks Grace Enda and Claire Haldeman for outstanding research assistance.

More than Voter Vitals

Dig Deeper

Source: https://www.brookings.edu/policy2020/votervital/did-the-2017-tax-cut-the-tax-cuts-and-jobs-act-pay-for-itself/

Posted by: thompsonthaut1977.blogspot.com

0 Response to "How Much Money Was Spent In Dec 2017"

Post a Comment