How To Get Free Money On Apple Pay

Get unlimited Daily Cash with Apple Card

See how to get a percentage of every Apple Card purchase back as Daily Cash, and learn where to find your Daily Cash.

What is Daily Cash?

When you buy something with Apple Card,1,2,3 you get a percentage of your purchase back in Daily Cash. There's no limit to how much Daily Cash you can get. And it automatically goes into your Apple Cash account, so you can use it just like cash.4

Learn how to see your Daily Cash >

If you share an Apple Card,5 each person earns unlimited Daily Cash for their own purchases. If you use Apple Card Family and you share your account with people under 18, set up Apple Cash Family. Each person accumulates their own Daily Cash on their own purchases.6

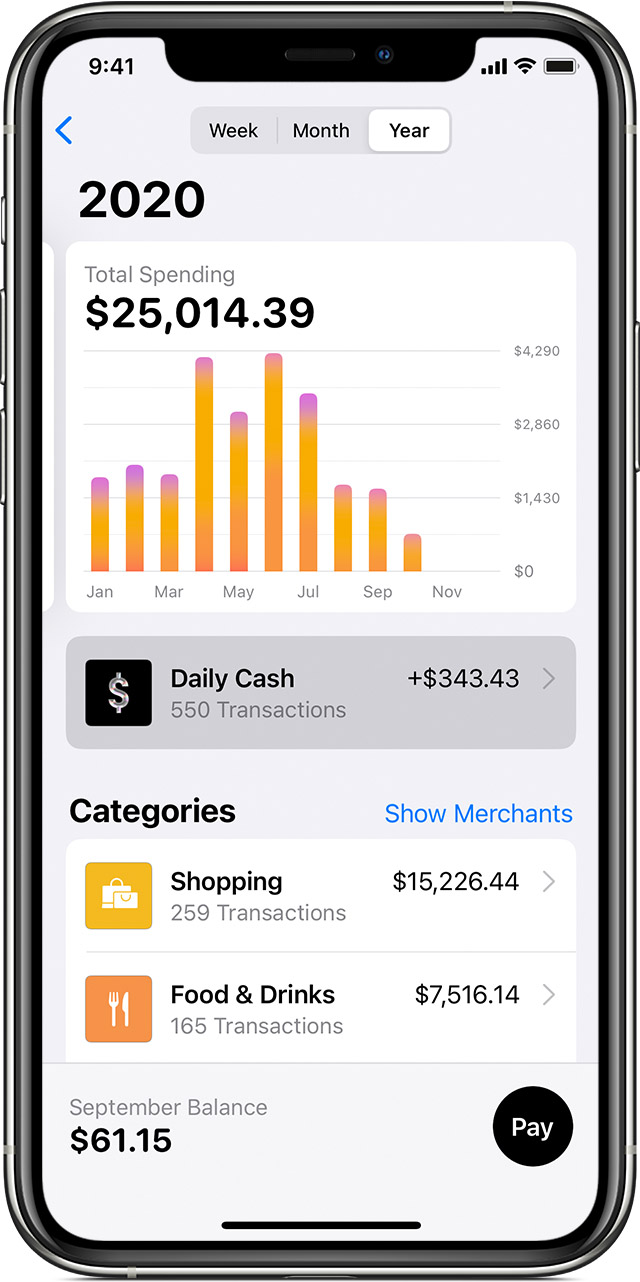

How to find your Daily Cash

- Open the Wallet app on your iPhone and tap Apple Card.

- Tap Weekly Activity, Monthly Activity, or Yearly Activity.

- To view a previous week, month, or year, swipe to the side.

For the week or month you selected, you can see all of the Daily Cash transactions from purchases that have settled. If you tap Daily Cash, you can also see the amount of Daily Cash you earned for each of those transactions.

To see the Daily Cash that you accumulated for a purchase, find that purchase in your spending history.

If you use Apple Card Family and you're the account owner or co-owner, you can see how much Daily Cash each person has accumulated.

What happens to Daily Cash when you return a purchase

If you return a purchase made with Apple Card, you are refunded the purchase price. The Daily Cash you received when you made the purchase is charged back to your Apple Card.

Use Daily Cash with Apple Cash

If you didn't set up Apple Cash

If you haven't set up Apple Cash yet, your Daily Cash from Apple Card purchases accumulates. The Daily Cash that accumulates can be applied to your Apple Card balance.

If your Apple Cash account is locked or restricted

If your Apple Cash account is locked or restricted, Daily Cash accumulates and can be applied to your Apple Card balance.

- Apple Card is issued by Goldman Sachs Bank USA, Salt Lake City Branch.

- To access and use all the features of Apple Card, you must add Apple Card to Wallet on an iPhone or iPad with the latest version of iOS or iPadOS. Update to the latest version by going to Settings > General > Software Update. Tap Download and Install.

- Available for qualifying applicants in the United States.

- An Apple Cash card is required. The Apple Cash card is issued by Green Dot Bank, Member FDIC. See apple.com/apple-pay for more information. If you do not have an Apple Cash account, Daily Cash can be applied by you as a credit on your statement balance. Daily Cash is subject to exclusions, and additional details apply. See the Apple Card Customer Agreement for more information.

- Apple Card Family participants and co-owners do not need to have a familial relationship, but must be part of the same Apple Family Sharing Group.

- An Apple Cash card is required. Participants under 18 on Apple Card Family accounts must have the family organizer of their Apple Cash Family set up their own Apple Cash card. If an owner does not have an Apple Cash account, Daily Cash can be applied as a credit on account owner's statement balance by contacting Goldman Sachs. If a participant has not set up Apple Cash, the participant or account owner can request that the accumulated Daily Cash be applied towards the owner's Apple Card balance by contacting Goldman Sachs. The Apple Cash card is issued by Green Dot Bank, Member FDIC.

Information about products not manufactured by Apple, or independent websites not controlled or tested by Apple, is provided without recommendation or endorsement. Apple assumes no responsibility with regard to the selection, performance, or use of third-party websites or products. Apple makes no representations regarding third-party website accuracy or reliability. Contact the vendor for additional information.

Published Date:

Thanks for your feedback.

How To Get Free Money On Apple Pay

Source: https://support.apple.com/en-us/HT209227

Posted by: thompsonthaut1977.blogspot.com

0 Response to "How To Get Free Money On Apple Pay"

Post a Comment